Are you still wondering why invest in Dubai real estate when there are property markets everywhere competing for attention? But, do you want to have a lifestyle and a home that not just gives you four walls, but makes you feel like waking up to eternal bliss every day? Think of that vast skyline that makes you feel like a tiny grain of sand while you are standing on your balcony facing a gorgeous waterfront marina, and below you, the city hums with life. In that moment, when you would feel those soft waves, and the smell of your favourite coffee, you wouldn't want the skyline to fade you away; you would want to stay under it like it's your escape, but it can be just your next morning routine.

More than the dreamy lifestyle, there are solid benefits of investing in Dubai real estate with amenities for a lifetime. This includes a tax-free environment, investor-friendly laws, and some of the highest rental returns in the world. The luxury structure of Dubai is what combines profit with security. So, let us help you give market insights on why to invest in Dubai real estate.

1. A City That Keeps Growing, And So Does Your Property Value

Dubai is not just a city that looks good in photos; it's a place that offers endless opportunities and where growth is constant. It has been observed that over the last decade, the city’s population has been rising fast. It is mostly fueled by working professionals and entrepreneurs who come here to work.

Furthermore, the city is also being filled with families who are choosing to make Dubai their permanent base. Every new arrival here adds to the demand for high-quality homes, from modern canal-side apartments to soaring towers with skyline views.

But this growth is not random; it's driven by a strong and diverse economy, and the masterminds behind the luxury structure of Dubai, with their strategic and visionary planning.

Dubai continues to thrive beyond oil, powered by industries like tourism, finance, trade, and technology. The government has made vast investments in Dubai’s infrastructure, like expanding metro lines and developing sustainable communities. Their continued effort shows that they value all the individuals, and it makes the city even more appealing to live, work, and invest in.

For investors, this means one thing: a market with consistent demand and properties that hold value over time.

Here’s Why Dubai’s Growth Matters for Property Investors:

- Rising population: More residents and expats create steady demand for rentals and sales.

- Thriving economy: Tourism, trade, and tech drive job creation, boosting housing needs.

- World-class infrastructure: New transport links, malls, and lifestyle districts attract long-term residents.

- Global magnet: Dubai draws talent, entrepreneurs, and tourists from across the world, keeping housing demand strong all year round.

Owning a property in Dubai real estate would open you to a view that stretches from the Burj Khalifa to a lively boulevard below. And knowing that there will always be tenants and buyers competing for a spot is a significant advantage. This is what makes Dubai different: it's not just a skyline, it’s a living, growing city where people and opportunity keep pouring in.

So, if anyone asks why invest in Dubai or is it good to invest in Dubai real estate, the answer lies in this momentum. A city that keeps growing, attracting people and building for the future, is a city where property investment isn’t just safe, it’s strategic.

2. Earn More Than Most Global Cities: Dubai’s Rental Yields and Growth

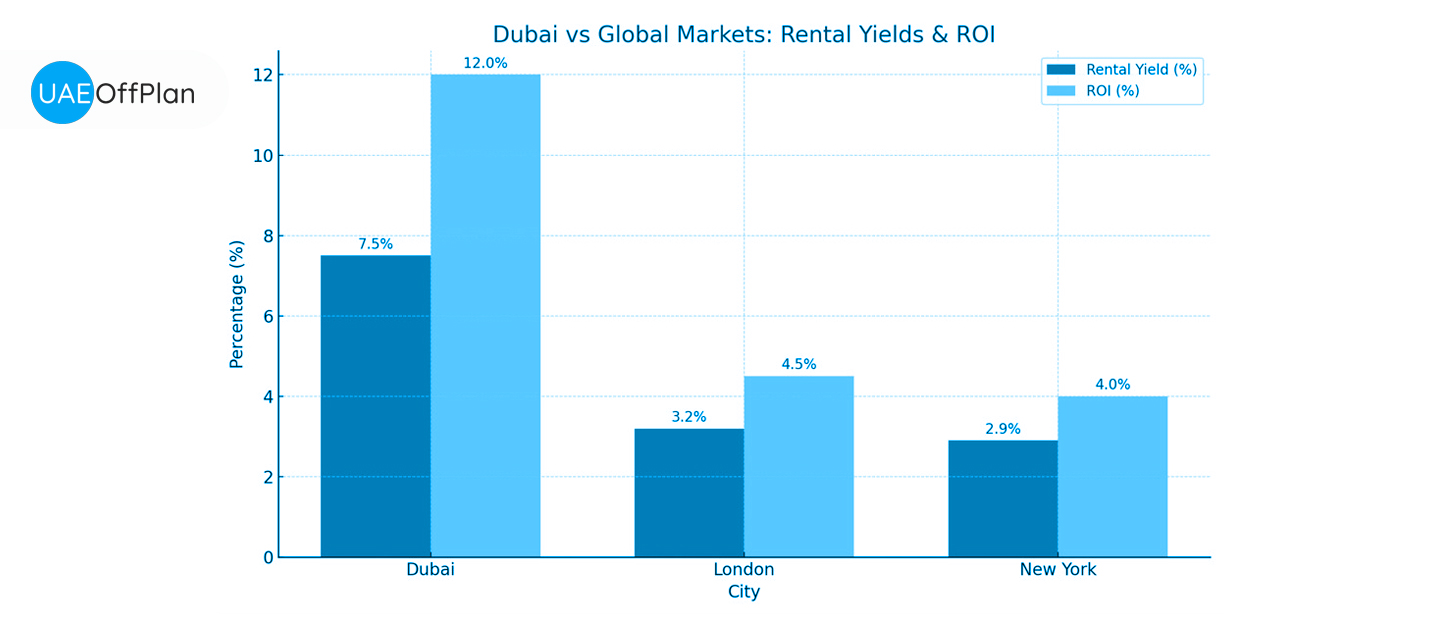

More than being a beautiful place to live, Dubai is a city where your property can genuinely work for you. The biggest thing that draws investors in is the impressive rental returns and steady value appreciation. This fact consistently outperforms many major property markets around the world

Unlike cities where high prices eat into profits, Dubai offers a unique balance. The relatively accessible entry points, compared to cities like London or New York with average rental yields between 6-8% annually, are highly attractive. These yields sometimes even perform higher in prime or emerging areas.

This means your investment can start paying you back sooner, whether you’re renting to long-term residents or tapping into the booming short-term rental market driven by Dubai’s 20+ million annual visitors. Therefore, if you still question is buying property in Dubai a good investment? You got your answer here.

What Makes Dubai’s Returns Stand Out?

- High rental yields: Properties often deliver 6–8% annually, higher than many Western markets.

- Consistent demand: Expats, professionals, and tourists create a strong rental pool.

- Capital appreciation: With prices rising steadily over the past few years, well-chosen properties can grow in value quickly.

- Short-term rental boom: Holiday homes and Airbnb-style rentals keep on thriving, thanks to Dubai’s evolving tourism industry.

And these numbers are not just abstract figures; they are your lifestyle stats. For example, if you own a one-bedroom in Business Bay, this could mean collecting steady monthly income while watching the city’s skyline evolve around you. Or, if you are going for a waterfront apartment near Dubai Marina, the benefits would take a double-take, giving you both a personal escape and a high-demand rental for visitors.

So, if anyone questions is it worth buying property in Dubai or is it a good investment zone, this is where the answer gives you clarity. In Dubai, owning or investing in a property means you are holding an asset that can generate cash flow now and build wealth for the future.

3. Keep More of What You Earn: Tax-Free Ownership & Investor Benefits

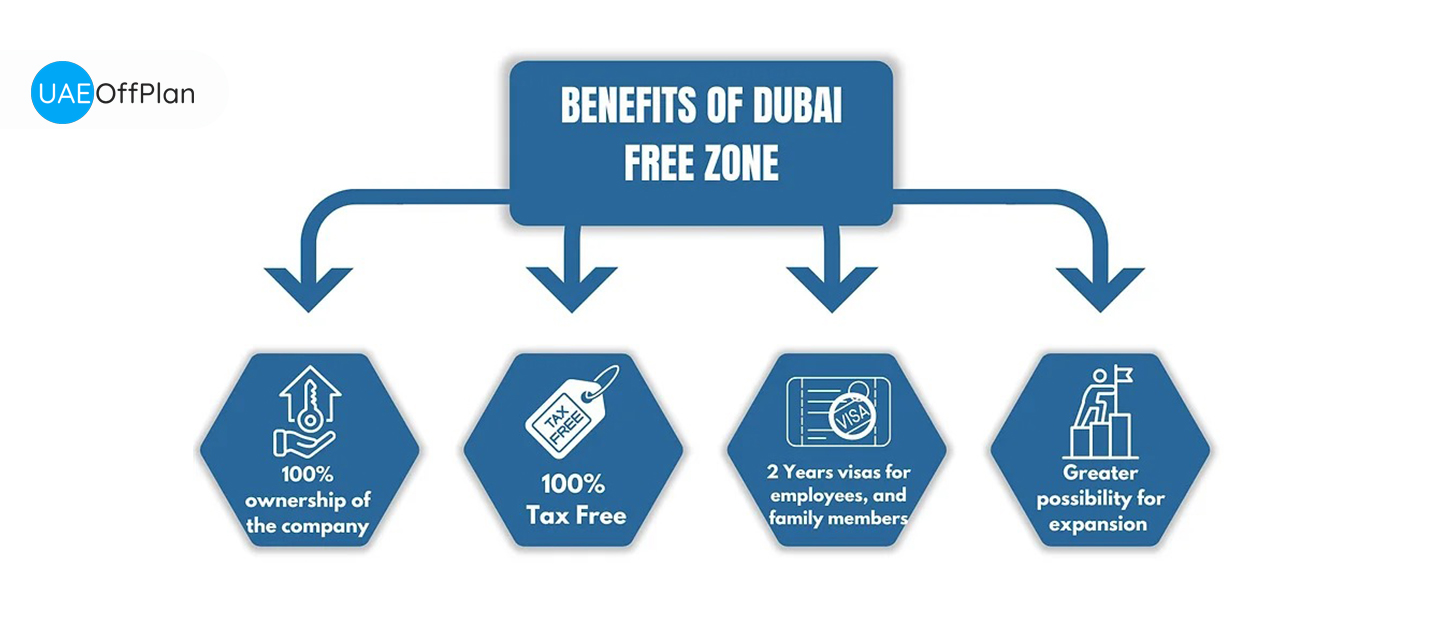

One of the main reasons that draws investors towards Dubai over other global markets is simple: you get to keep your earnings and profits with you. We know that in most major cities, rental income and capital gains are heavily taxed, eating into returns. But in Dubai, there are no property taxes, no capital gain taxes, and no income taxes either on rental earnings. What you make is yours, and no one is taking it away from you.

But yes, it's not only about the lack of taxes. Dubai has gone out of its way to make property ownership easy and rewarding for international buyers and investors. The government has introduced policies that make investing even more rewarding.

Here’s What Sets Dubai Apart for Property Investors:

- No property or capital gains tax: Your rental income and profits stay with you, not the tax office.

- 100% foreign ownership in freehold areas: You own your property outright, with full rights to sell, rent, or pass it on.

- Golden Visa eligibility: Invest a certain amount, and you can secure long-term residency for yourself and your family.

- Streamlined property laws: Clear regulations, digital processes, and investor-friendly frameworks make buying and selling smooth.

So, are you already imagining closing on a sleek apartment in Downtown Dubai? Knowing every dirham of your rental income comes to you, without any deductions, no surprise fees. Or do you want to purchase a family villa in a freehold community where you can unlock a Golden visa, which gives you a sense of stability?

Options here are seamless and smooth, and if anyone is still thinking whether is Dubai a good place to invest in property, know that these tax benefits and ownership freedoms are a game-changer. Few markets in the world offer such investor-friendly conditions, and even fewer combine them with the lifestyle and returns that Dubai does.

4. Safe, Transparent, and Built for Investor Confidence

For many international buyers, the biggest hesitation about investing abroad is trust. These questions are always somewhere in the corner of their head: Will my money be safe? Are the laws reliable? Dubai understands this, which is why its property market is built on transparency and protection, making it one of the most secure places to buy real estate globally.

The city’s property laws are overseen by the Dubai Land Department (DLD) and the Real Estate Regulatory Authority (RERA). They ensure that every transaction is legitimate, fair, and safeguarded.

So whatever choice you make, whether you’re buying a ready apartment or an off-plan unit, your investment is protected by strict rules and systems designed to eliminate risk.

This is How Dubai Protects Property Investors:

RERA-regulated developers and brokers: Only licensed professionals can operate, reducing the chances of fraud. This is also advice that you should only work with RERA-certified agents.

- Escrow accounts for Off-Plan Projects: Your payments are held securely and released only as construction progresses.

- Clear Title Deeds: Every property purchase comes with an official title, registered with the DLD.

- Digital Processes: Transparent online systems for transfers, registrations, and fee calculations keep everything clear.

So, you can completely finalize your investment and property purchase, and walk out with a registered title deed in your hand, knowing your money is secure. They keep records to recognize your ownership, and your investment is protected by law. There is always a sense of confidence that comes with investing in a market where everything is structured and traceable.

So, if anyone is still unsure and wondering is it safe to invest in Dubai real estate or is it safe to buy property in Dubai, the answer is yes. Why? Because every step, from your first payment to your final handover, is designed with your security in mind. Not all property markets worldwide offer this level of reassurance, especially without any tax, and still deliver strong returns and lifestyle benefits.

5. Diverse Investment Opportunities Across Dubai

Make a chart of different property types like luxury villas and apartments.

Dubai real estate investment opportunities are diverse and ever-growing; there is no one-size-fits-all strategy. And that is why it attracts investors globally. If you want to invest in property in Dubai, you will have opportunities for every budget and lifestyle. Whether you are going for a luxury penthouse with your private rooftop pool, a family-friendly villa surrounded by parks, or a smart off-plan apartment in a prime location, the options are endless. This diversity means you can shape your investment to match your goals.

What Makes Dubai’s Property Landscape so Appealing?

- Luxury icons: Areas like Downtown Dubai and Palm Jumeirah cater to high-net-worth investors seeking prestige and panoramic views, with strong long-term value.

- Vibrant city living: Business Bay and Dubai Marina offer sleek apartments with consistent rental demand from professionals and expats.

- Emerging hotspots: Communities like Jumeirah Village Circle (JVC) and Dubai Hills Estate provide more affordable entry points with strong growth potential.

- Off-plan opportunities: Buying during construction often means lower prices, flexible payment plans, and higher appreciation once the projects are complete.

- Commercial spaces: Since Dubai’s economy is expanding, office and retail properties are becoming increasingly attractive for business-minded investors.

Now, imagine you are stepping into your own apartment in Dubai Marina that has modern interiors and floor-to-ceiling windows with the windows framing yachts below. And the fact that demand for rentals in this area never slows will reassure you on every step you take into that apartment. Or if you own an off-plan unit in Dubai Hills Estate, know that by the time the keys are handed over, its value may already be higher than what you paid.

The answer to the question of whether is it worth investing in real estate in Dubai or what are the benefits of buying property in Dubai, is straightforward: very few markets have such a large selection of options, all of which are supported by demand and room for expansion. Dubai offers real estate that may fulfil your vision and reward it. Regardless of your level of experience as an investor.

6. Why Dubai Outshines the Rest?

Apart from being a financial asset, Dubai is a key to an unmatched lifestyle that you would keep coming back to. Because it offers:

- Pristine Beaches and Marinas: These spots will bring you the type of calm and contentment that you might have never experienced before. You can spend your weekends by the water or dine in with skyline views. You will love it.

- World-Class Amenities: Everything feels glitzy, from Michelin-starred eateries to upscale shopping centres. So, going shopping with girls or spending a night at the movies with friends? That's a yes.

- Unmatched Safety: Dubai consistently ranks among the safest cities in the world. Everyone strictly follows the policies and laws, taking care of the rules and regulations as well.

For investors who also want a personal escape, Dubai gives both: a profitable asset and a lifestyle upgrade. So, is investing in Dubai a good idea? Definitely.

And Why 2025 is a Perfect Moment to Invest:

Property prices continue to rise but remain competitive around the world, compared to London or New York. Moreover, if you consider some of the major Western markets, in Dubai, the rental yields are often double those of them, 6-8%. And new off-plan projects are on the way, offering lower entry prices and flexible payment plans like 1% monthly. So, investing in property in Dubai right now can provide you with fruitful returns in the future.

Here’s What Makes Dubai Unique On a Worldwide Scale:

- No Property or Capital Gains Tax: Your profits stay yours.

- Full foreign Ownership: Freehold areas give you complete control.

- High demand: A growing expat population and booming economy keep rentals always occupied.

Many other cities may offer luxury, but Dubai pairs it with profitability, while making every process simple. So, the answer to why invest in Dubai real estate is clear: Dubai is a market built to protect and reward investors, with a world-class lifestyle and strong returns.

Why Dubai Real Estate Deserves Your Attention

If you’re still wondering why invest in Dubai real estate, the answer is simple: Dubai is the city where strong rental yields and tax-free ownership come together. Moreover, you can enjoy a world-class lifestyle with top-tier amenities alike. Dubai is expected to rank among the world's most lucrative real estate markets in 2025 due to its expanding economy, which comes with consistent demand and investor-friendly regulations.

Investors can grow their portfolio, enjoy steady returns, or even secure a personal retreat, all while owning property in a city built for growth and opportunity. Now is the time to discover what investing in Dubai real estate can do for you.

FAQs

Is Dubai real estate a good investment?

Dubai offers rental yields that reach an average of 6–8%, tax-free income. Moreover, it continues to expect strong demand from a growing expat population, making it a profitable and secure market. So, is it good to invest in Dubai? Definitely.

What are the benefits of real estate in Dubai?

Tax-free ownership, no capital gains tax, full foreign ownership in freehold zones, high rental yields, and access to a luxury lifestyle with long-term growth potential.

Is it wise to buy a house in Dubai?

Yes. The market is well-regulated, provides you with diverse property choices with flexible payment plans, and strong appreciation, making it ideal for both living and investment.

Can foreigners buy property in Dubai?

Absolutely. Foreigners can purchase freehold properties in designated areas, owning them outright with full rights to sell, rent, or transfer ownership.

Do you pay tax on property in Dubai?

No. There are no property or capital gains taxes. You just have to pay a one-time registration fee and standard maintenance costs.