In 2025, the Dubai property market will offer more than just lifestyle perks. Beautiful homes and beachside brunches, yes, that’s a win. But, if you are planning to relocate there, how about investing in something that grows as fast as you do?

Buy the view. Earn the return. Secure the lifestyle. Dubai lets you do all three.

Your ambitious personal move could offer you fruitful returns if you think about buying your first apartment here, or just invest, or explore the real estate scene. From high rental yields to continuous capital growth, your wise thinking right now can give you massive ROI in the future.

Let’s explore the Dubai property market further and help you understand how your personal move could also become a powerful and profitable investment.

Dubai Real Estate Breakdown:

Here, we will cover the following aspects of the Dubai property market:

- Dubai Real Estate Snapshot: Prices Are On The Rise

- The Real Reasons Behind Dubai’s Red-Hot Property Market

- The Lifestyle ROI: Owning Property in Dubai

- Dubai Property Market Outlook: What Investors Need to Know for 2025

- Dubai Tops UAE Charts in Price Growth & Demand

- Key Market Indicators

- Profit with Purpose: Dubai Property Investment Tips

- Risk Factors to Watch

- Should You Invest in Dubai Property? Here's What to Consider

- Smart Tips For You To Invest Wisely

- Real Buyer Scenarios Of Real People

- Is Dubai The Right Fit For You?

- Ready to Make a Smart Move in UAE Real Estate?

- FAQs

Dubai Real Estate Snapshot: Prices Are On The Rise

Strong and steady growth of the property prices in Dubai has been observed over the last few years. Average home prices were nearly 19.5% higher than the year before by the end of 2024. Similarly, growth in previous years has increased by 20% in 2023 and approximately 9.5% in 2022. And 9.25 in 2021.

Apartments and villas have seen solid price increases:

- Apartments are increasing by about 19.4% year over year

- Villas have also slightly gone up the chart, at around 20.3%.>

This observation indicates that the values of the Dubai real estate market are rising every year, and it's a golden time to invest in a booming future.

The Real Reasons Behind Dubai’s Red-Hot Property Market

What's driving Dubai’s property boom? Let's have an overview of the current state:

Dubai’s Population Growth

Around 90,000 people have moved to Dubai in 2025, in just the first three months. That is basically 1000 residents per day, and more residents mean a greater demand for new homes.

Investor-Friendly Perks

Dubai continues to attract global buyers and investors with its tax-free income and long-term Golden visa opportunities. Moreover, the luxurious lifestyle never ceased to make us look twice at Dubai.

Massive New Supply

According to the latest Dubai real estate news, the city plans to deliver 73,000 new homes in 2025 and over 210,000 units by 2026. This could also cool down the prices, as well as create better entry points for buyers.

Luxury & Off-Plan Sales Rising

High-end villas are in huge demand, and many investors choose off-plan properties because of the super-easy and flexible payment plans, offering as low as 1% monthly. So, while the momentum is hot, it's a smart opportunity to make a wise investment.

The Lifestyle ROI: Owning Property in Dubai

Investing in the Dubai housing market is more than just a smart investment; it offers you a blend of security and a lifestyle that comes with comfort and elegance. Let's explore how:

Zero-Income Tax: Higher Returns

There are no annual property taxes that you need to pay, as well as you can enjoy tax-free rental income. This means you can save faster and often, ideal for investing in a valuable and secure future.

Global Connectivity

Dubai offers secure flights to 240+ destinations with two major airports. So, if you are someone who loves to travel or needs to go for business trips, you will be connected to Asia, Europe, and Africa with ease.

Invite Luxury Into Your Daily Life

Starting from golf communities in Arabian Ranches to waterfront towers in Dubai Marina, here, homes offer you resort-style living. You will also get exclusive access to pools, gyms, spas, and private services.

Safe & Wise Living

Dubai is one of the world’s safest cities. It offers you top-tier healthcare, smart infrastructure, and peace of mind for everyone, whether families or individuals.

Welcomes Expats

Furthermore, since 85% of the population in Dubai is made up of expats, it is built for the comfort of global citizens. Living and investing here is surely something that will open you to world-class opportunities in the future.

Dubai Property Market Outlook: What Investors Need to Know for 2025

The real estate market in Dubai continues to show steady growth with strong fundamentals.

Strong Growth Ahead

According to Deloitte, the property market of Dubai is set to carry its momentum through 2025. However, the prices may slightly drop due to oversupply, but it certainly brings better opportunities for first-time investors to explore the real estate scene for a secure future.

Continued Demand

Dubai, being a destination for a luxurious lifestyle and lifetime living benefits, analysts from ValuStarts predict that there will be a continued demand because of foreign investors and population growth.

Risk Perspectives

Fitch states that a potential oversupply can lead to prices dropping by up to 15% by late 2025–2026. However, the Dubai property market forecast has its roots set in the strong, so it's a wise time to invest for exceptional future returns.

Dubai Tops UAE Charts in Price Growth & Demand

Dubai continues to experience overhead price growth and demand as compared to emirates like Abu Dhabi, Sharjah, and Ajman. This is observed by a steady trend seen in Dubai property prices last 10 years, which estimates that Dubai will continue to top the UAE charts.

Moreover, Dubai saw the highest price increase across the UAE in 2024 alone. With residential values rising by over 19% year-over-year.

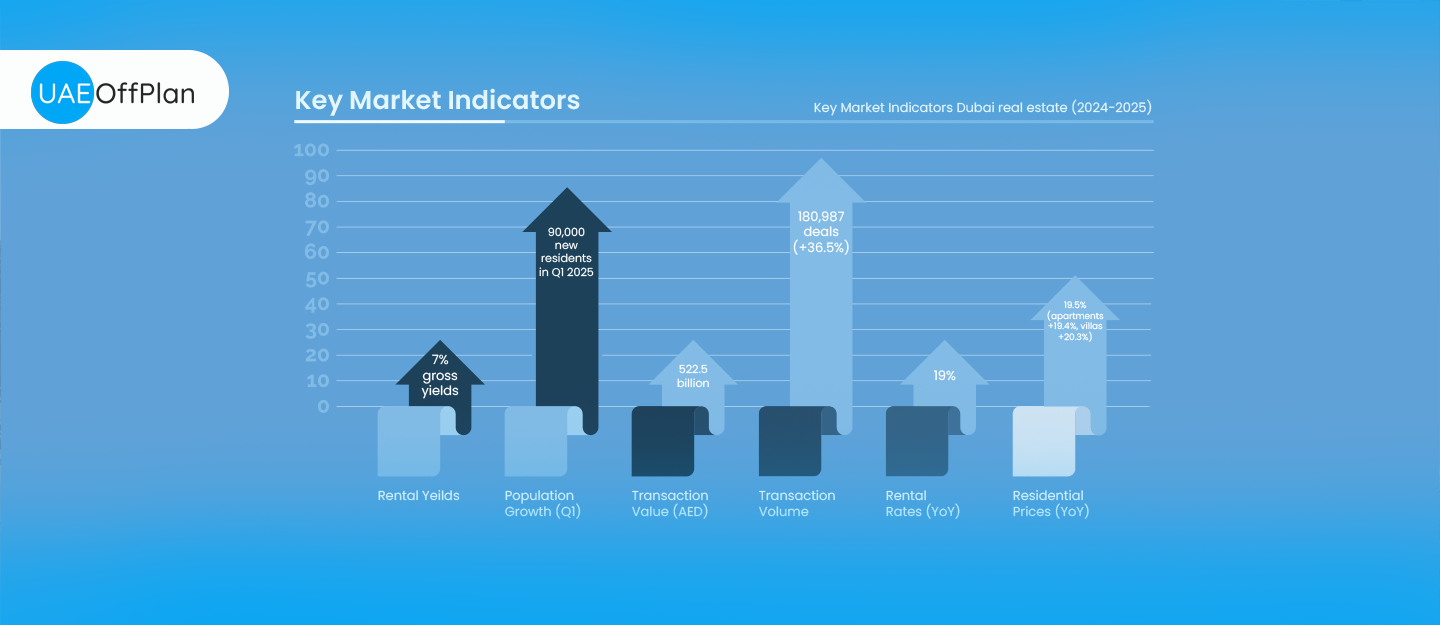

Key Market Indicators

Residential Prices (increased yoy): 19.5% (apartments +19.4%, villas +20.3%)

Rental Rates (increased): 19% yoy

Transaction Volume: 180,987 deals (+36.5%)

Transaction Value: AED 522.5 billion

Population Growth: 90k new residents in Q1 2025

Rental Yields: 7% gross yields

This shows that the Dubai property index is active and still offering strong returns in rental income and capital gains.

Profit with Purpose: Dubai Property Investment Tips

High Rental Yields

Dubai offers around 7% rental returns, which is greater than many Western cities like London or New York. This makes it ideal for having a steady income for passive income seekers.

Capital Growth Potential

Since 2020, property prices in Dubai have climbed by 124%. This shows that Dubai has high potential with strong roots that continue to be appreciated globally.

Off-Plan Advantages

Dubai offers you flexible off-plan payment plans, like 1% monthly, which is the most opted for. It lets you invest gradually, and by the time it is completed, your property price will have skyrocketed.

Smart Location Picks

Dubai Marina, Palm Jumeirah, and Emirates Hills are some of the premium areas with great benefits and, of course, great upside. Yet, they are still more affordable than places like London or New York.

Risk Factors to Watch

While investing smartly, you need to be ahead of what can happen further:

Oversupply

Too many new properties might hit the market, which can result in temporary dips in property rates. But, this also offers an easy chance for investors to invest at a better value.

Global Fluctuations

Rental market shifts or oil price swings can slow down the demand, but Dubai’s versatile and diversified economy offers protection policies.

Urban Growing Painpoints

A high population can lead to traffic congestion and rising costs, which are being addressed by metro expansion and smart city planning, according to the latest insights from real estate news Dubai.

Should You Invest in Dubai Property? Here's What to Consider

If You Are Relocating

Pros: Tax-free income, luxurious lifestyle, strong ROI and rental yields, and valuable long-term growth.

Cons: Higher living costs if you are renting, 4% DLD transfer fee when buying, and legal formalities.

If You Are Investing Remotely

Pros: Good potential to combine rental income and capital gains that also come with flexible off-plan entry points.

Cons: Requires a trusted local partner, can have a risk of delayed handovers, and global economic shifts can also have an impact.

Smart Investor Moves

- Work with RERA-registered agents only, and always consider and verify paperwork.

- Go for areas that are high in demand with strong rental appeal and active tenant activity.

- Run ROI stress tests. Check if your investment is still profitable if prices drop by 10-15% by using conservative rent growth estimates for the long term.

- Watch out for the supply pipelines in your area. Buy before the price peaks, and you can always exit early if an oversupply is expected.

Real Buyer Scenarios: What Success Looks Like

The Remote Investors: Maria & Erik

This was an expat couple from Sweden; they bought an off-plan 2BR in JVC in 2021 with 1% monthly plan. In 2024, their property had skyrocketed to 35% and they are earning a steady 7.2% rental income from it.

First-Time Buyer From Pakistan, Raheel

He moved to Dubai and chose to buy instead of rent. Bought a 1BR apartment, and that not only gives him a sense of security, but also qualifies him for a Golden Visa.

Digital Nomad from South Africa, Zartashia

She bought a studio in Dubai Marina in early 2022. She lives there part-time, and for the rest of the time, nearly 90%, rents it on Airbnb. This makes her earn a steady income for the rest of the year.

So, are you imagining sipping your morning coffee on a Marina-view balcony? Or earning from your beachfront apartment while you work remotely? In Dubai, you can certainly explore all the possibilities, and your profit can go hand in hand!

Is Dubai The Right Fit For You?

If you agree with two or more of these, then you are ready for your next, solid move:

- You want tax-free rental income.

- You are attracted to modern living and a global vibe.

- Flexible, low-commitment payment plans are your priority.

- You want to live or earn in a city that is ranked as one of the safest in the world.

- You want high-growth investment, looking for extensive returns.

Do these click? If yes, then you are ready to take the wheel for a fruitful future!

Ready to Make a Smart Move in UAE Real Estate

In 2025, the Dubai property market continues to grow, offering high rental yields and an elegant lifestyle that will always feel like the right choice.

Are you looking for personal guidance and insights on UAE property prices? Book a viewing today and speak with an expert to explore your ideal investment. Start planning your dream future today!

FAQs

1. Is property in Dubai a good investment?

Yes. Dubai offers high rental yields, tax-free income, and strong Dubai real estate transactions. So, investing here can provide you with long-term, valuable returns.

2. What is the property market prediction for Dubai 2025?

Many experts have predicted steady growth in 2025, but because of oversupply, the property rates in Dubai might hit a temporary dip. However, the demand continues to grow, backed by high transactional volumes.

3. Is Dubai a good city to invest in real estate?

Yes, definitely. It's an appealing destination for property investors offering high returns and modern living. Also, it offers a luxurious lifestyle with long-term benefits that invites expats all year round.

4. Is the Dubai property market overheated?

No, the price growth reflects real demand and economic strength. While the oversupply may cool the property rates slightly, Dubai real estate transactions will stay steady, not overheated.

5. Is It Profitable To Buy A House In Dubai?

If someone wants to earn steady rental income, then buying a house in Dubai is definitely profitable. It can bring strong returns that come tax-free with 7% yield.

6. What Is The Minimum Salary To Buy A House In Dubai?

With 4% interest rate, most banks will require a monthly salary of AED 15K to 25K for a home loan or mortgage. However, cash buyers might have more flexibility.